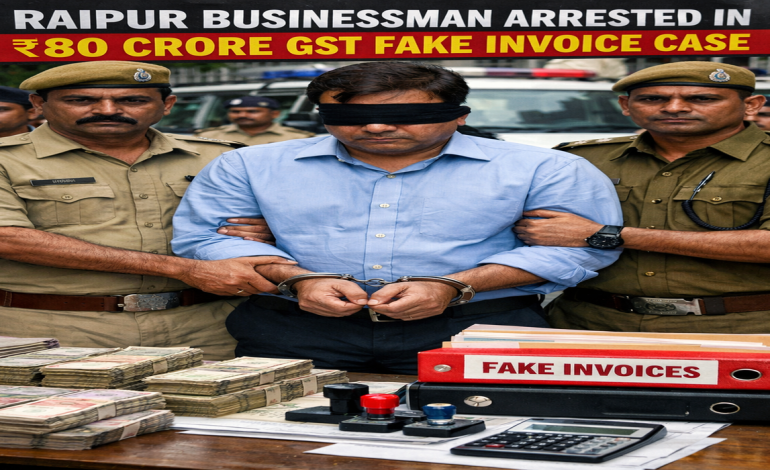

Businessman Arrested in Major GST Fraud

The Directorate General of GST Intelligence (DGGI), Raipur Zonal Unit, arrested Santosh Wadhwani for GST evasion involving fake invoices worth over ₹80 crore. The fraudulent invoices were allegedly used to claim illegal input tax credit (ITC). Consequently, the government suffered a revenue loss of around ₹14 crore.

Investigation Details

Officials said Wadhwani was taken into custody on the night of January 29. Investigators found that he issued fake invoices without supplying goods or services. As a result, he wrongfully claimed ITC, violating GST laws.

The investigation revealed that Wadhwani used a company registered under his son’s name, M/s Vijay Laxmi Trade Company. The firm existed only on paper and served as a conduit for fake invoicing. Authorities confirmed that no real business transactions matched the invoiced amounts.

How the Fraud Was Detected

The DGGI discovered the fraud using intelligence reports and data analytics. They analyzed:

-

Bank statements

-

GST returns

-

E-way bills

-

Other financial transactions

This analysis uncovered circular transactions and fraudulent ITC claims, exposing a well-organized fake invoicing network.

Legal Action Taken

Officials acted under Section 69 of the Central GST Act, 2017, allowing arrests for serious tax offences. The offence carries penalties under Section 132, including imprisonment and heavy fines.

After arrest, Wadhwani was produced before the Raipur district court. The court remanded him to judicial custody, and he was sent to Raipur Central Jail. The investigation is ongoing to identify other firms or individuals involved in the fake invoice network.

DGGI’s Ongoing Crackdown

The DGGI Raipur Zonal Unit stated it will continue targeting GST evasion and illegal financial activities. Officials urged businesses to comply strictly with GST laws and maintain transparent records. They warned that stringent action will follow for anyone found guilty of fake billing or tax fraud.

Tax experts noted that GST offences above ₹5 crore are serious. Such crimes can lead to up to five years of imprisonment and heavy fines. This case is one of Chhattisgarh’s major GST enforcement actions, emphasizing the government’s commitment to curbing tax fraud and protecting revenue.